Understanding The Concept Of Layer 2 Solutions

February 28, 2025The Future Of Binance Coin (BNB) In 2023

March 1, 2025

How to Use Trading Strategies for Bitcoin (BTC) Investments

Bitcoin, the first and most well-known cryptocurrency, has been a popular choice among investors since its inception in 2009. With its limited supply and growing demand, Bitcoin’s price has fluctuated significantly over the years, making it an attractive asset for traders looking to make money through buying low and selling high. In this article, we’ll explore how to use trading strategies for Bitcoin investments, helping you navigate the world of cryptocurrency trading with confidence.

Understanding Bitcoin Trading Strategies

Before diving into specific trading strategies, it’s essential to understand what makes Bitcoin tick. Here are some key points to consider:

- Price Action

: Bitcoin’s price is influenced by market sentiment and fundamental factors such as supply and demand, interest rates, and economic indicators.

- Technical Analysis: Technical analysis involves analyzing charts and patterns to predict price movements.

- Fundamental Analysis: Fundamental analysis examines a company’s financial performance, industry trends, and overall health.

Popular Bitcoin Trading Strategies

Here are some popular trading strategies for buying and selling Bitcoin:

- Mean Reversion Strategy: This strategy involves buying Bitcoin when it falls below its 50-day moving average and selling when it rises above.

- Bollinger Bands Strategy

: This strategy uses Bollinger Bands, a technical indicator that shows volatility, to identify potential price movements.

- Trend Following Strategy: This strategy involves identifying and following trends in the Bitcoin price chart.

- Range Trading Strategy: This strategy involves buying when the price falls within a certain range and selling when it rises beyond that range.

- News-Based Strategy: This strategy involves reacting to news events, such as announcements or changes in government policies, which can impact Bitcoin’s price.

Using Trading Strategies for Bitcoin Investments

To use trading strategies for Bitcoin investments, follow these steps:

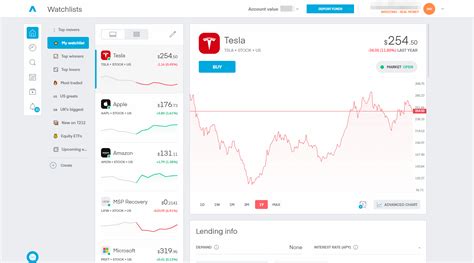

- Choose a Trading Platform: Select a reputable trading platform that supports Bitcoin trading and offers the tools and resources you need to execute trades.

- Set Your Risk Tolerance: Determine how much risk you’re willing to take on each trade based on your investment goals and risk tolerance.

- Develop a Trading Plan: Create a plan for using your chosen strategies, including entry and exit points, stop-loss levels, and profit targets.

- Monitor the Market: Continuously monitor the Bitcoin price and adjust your trading strategy as needed.

Example Trading Strategies for Bitcoin

Here are some example trading strategies that you can use to trade Bitcoin:

- Mean Reversion Strategy:

* Buy when BTC falls below $2,000

* Sell when BTC rises above $4,000

- Bollinger Bands Strategy:

* Buy when the price drops below the lower band and rises above the upper band

* Sell when the price breaks above the middle band

- Trend Following Strategy:

* Buy when the price falls below a 200-period moving average and rises above a 50-period moving average

* Sell when the price rises above a 200-period moving average

Tips for Successful Bitcoin Trading

To increase your chances of success with trading strategies, keep these tips in mind:

- Stay Disciplined: Avoid impulsive decisions based on emotions or market sentiment.

- Diversify Your Portfolio: Spread your investments across different assets to minimize risk.

- Continuously Learn: Stay up-to-date with market news and analyze the performance of other traders.

- Use Risk Management Tools: Utilize tools like stop-loss levels, take-profit targets, and position sizing to manage risk.